2023 Retail Snapshot: Mapping mobile habits.

By Elissa Quinby

Apr 11, 2023

6 min read

By now, it’s almost trite to say we are a mobile-first world. Reports from Insider Intelligence predict that mobile commerce will grow another 15% in 2023 alone. But, what does that mean for the mobile experience? And where should retailers be prioritizing investments in mobile optimization?

To uncover the answers to these questions and others, we went to Quantum Metric’s own data to examine anonymized aggregated insights on digital behaviors over the last two years. What we found is that mobile adoption is not only trending upward, it’s creating a huge opportunity to drive new revenue and customer loyalty—if the experience is right.

Looking at device adoption from both sides.

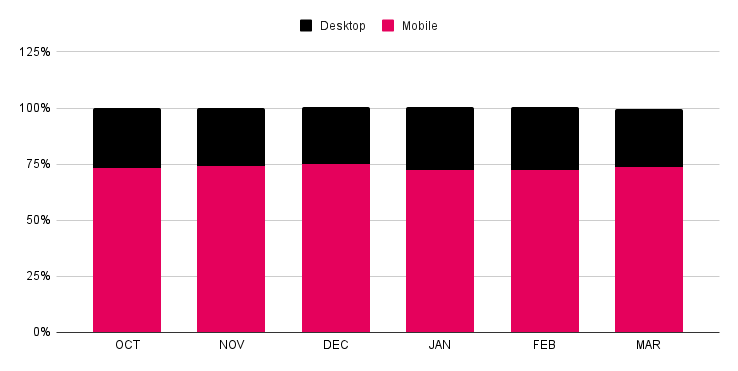

Mobile usage is higher than ever before. In Q1 2023 alone, mobile makes up an average of 74% of monthly traffic to digital properties. Well above the majority, Q1 2023 traffic levels are also 9% what they were in Q1, 2022.

Monthly traffic shares by device: Oct. 2022 – March, 2023

All that said, it’s not necessarily over for desktop. In fact, desktop continues to make up just under 30% of digital traffic, despite seeing a 17% YoY decline in traffic between Q1, 2022 and Q1, 2023. This shows that while the majority of consumers are making the move to mobile-first, there are still customers that are not ready to switch over. Convenience is not enough, it will take a heightened experience that feels comparable to desktop to get them to make the switch.

Mobile is making the move from research to purchase.

Alongside traffic, mobile is also driving retail revenue in 2023. Quantum Metric’s data shows that mobile is not just for research any more and in fact, customers may be even more comfortable making purchases on mobile versus desktop. In the first quarter of 2023, mobile made up 62% of monthly sales.

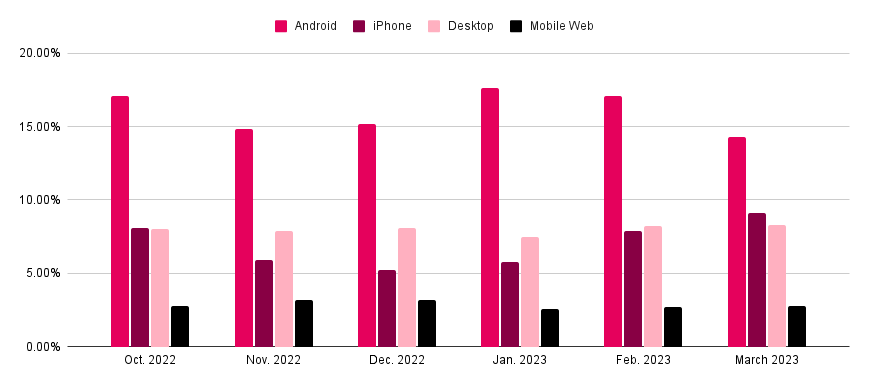

When it comes to conversion rates, or the percentage of visitors to a retailer site that made a purchase, mobile saw a 13% increase in monthly conversions between December, 2022 and March, 2023. So, between native apps and mobile web, who sees higher conversions? Native apps. In fact, apps earned an average monthly conversion rate over the last six months that was four times higher than mobile web. Breaking things down even further Android-specific native apps see the highest conversion rate, with a 129% lead on average over Apple.

Monthly conversion rates by device type: 2022-2023

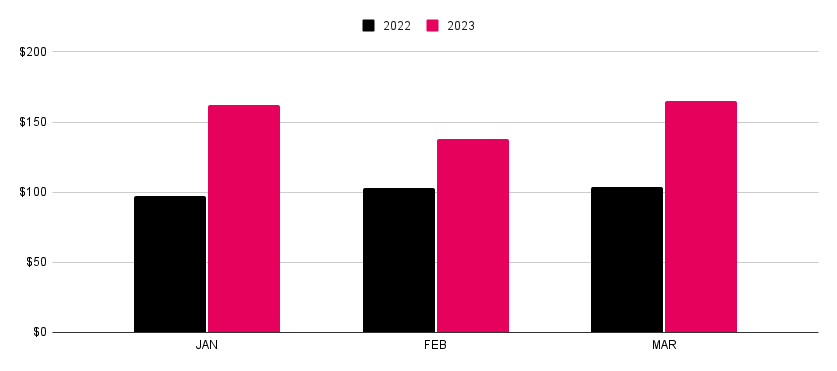

As conversions climbed in early 2023, so did average order value (also known as the average cost of consumer’s purchases). Between Q4, 2022 and Q1, 2023, average order values grew from a monthly rate of $121 to $125. Not to mention, when you look year-over-year average order values for Q1 have grown 23% between 2022 and 2023. This is all despite economic instability, higher living costs and tighter consumer budgets.

Q1 monthly average order values for mobile: 2022-2023

The takeaway? The mobile experience is becoming a major driver for purchases and it’s not just small, one-off items. Consumers are using mobile to research and make higher value or bigger cart purchases. In response, retailers need to focus their mobile optimization efforts on continuing to build purchasing confidence and maximizing value.

With the right investments and tools, mobile will drive revenue in 2023.

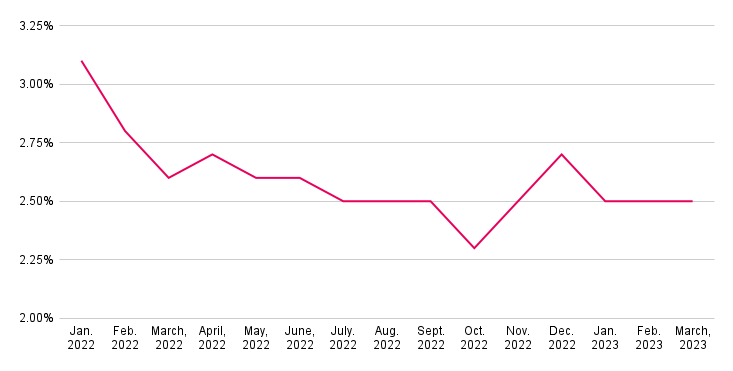

The key to keeping confidence and order values up? Keeping frustration and abandonment down. Quantum Metric data showed that brands who use our platform for mobile analytics, have seen a 12% drop in average monthly frustration rates and a 2% drop in average monthly site abandonment rates between Q1 2022 and Q1 2023. All while their average order values increased by 23%.

Monthly mobile frustration rates: 2022 – 2023

To drive revenue and efficiency in their mobile experience in 2023, retailers need to prioritize investments in mobile analytics that provide insight and context into the unique journey customers are having on mobile. This will enable teams to uncover how to prioritize initiatives such as:

- The mobile first-screen experience – diving into if and how your customers are scrolling on mobile web or app and minimizing frustrations that can cause them to leave before they are engaged.

- Building parity between mobile and desktop – examining how resizing images, product or text placement can create a completely different experience and drive adoption.

- Simplifying the purchasing experience – understanding how one-click, minimal step purchasing options can ease the purchasing experience, drive upsells and boost return purchases.

Most importantly, investments in mobile analytics build happy customers. Happy mobile customers are more loyal to a brand, opting to not just purchase one item, but building their cart with the number of things they might need. They have the potential to become a mobile customer for life.

For more insight on consumer behaviors from the holidays and beyond, check out our latest retail benchmark report, The Holiday Wrap-up.

Want to know how Quantum Metric can help you reduce customer frustration and maximize revenue on mobile? Dive deeper into our mobile optimization capabilities with a demo.

share

Share