Trends & best practices

Travel snapshot: Checking-in on booking behaviors.

By Tom Arundel

Oct 3, 2022

6 min read

The summer of 2022 travel held a lot of promise as travel restrictions loosened and more people were comfortable with the idea of traveling again. After two years of being at home, more than half of consumers (54%) noted in early spring that they were planning to spend more on their rebooked trips than they did pre-pandemic.

But just as travel brands were celebrating the boom, concerns about a recession, inflation, and rising fuel prices caused many to cut back on their consumer spending. Did this pop the summer travel balloon? And what can consumer behaviors during the last few months tell us about opportunities for the rest of the year?

To answer these questions and others, we took a look at anonymized customer data from some of the biggest global travel brands between January 2021 – September 2022. Here’s what we uncovered:

Inflation downsized plans, but didn’t temper travel demand.

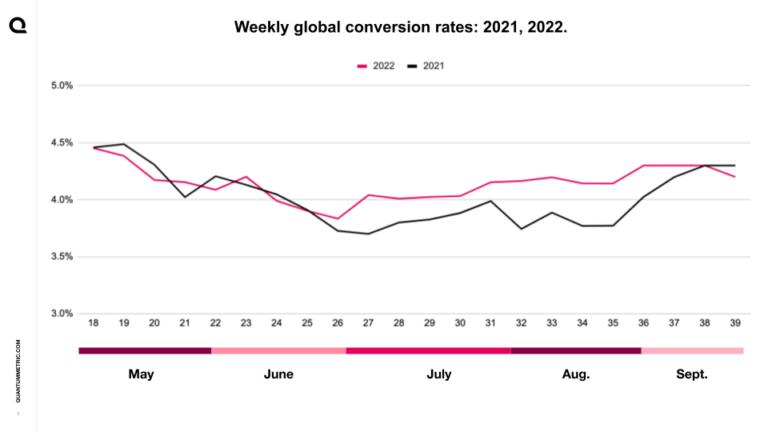

Taking a look at global conversion rates between May and September, we saw the traditional seasonal decline as summer started. However, with higher traveler confidence, that decline was less severe. Weekly conversion rates between May and September 2022 were 5% higher compared to the same time last year. August saw the most improvement with 10% YOY growth in weekly conversion rates, with July seeing 6% YOY.

Simply put, travelers’ desire to get out of their homes exceeded their concerns about budget. Instead of limiting their travel, consumers adjusted their spending limits. Average order values declined 10% between June and July, which indicates consumers either downgraded or sought lower-cost travel options, without giving it up completely.

Day-of-travel mobile experiences helped drive record traffic levels.

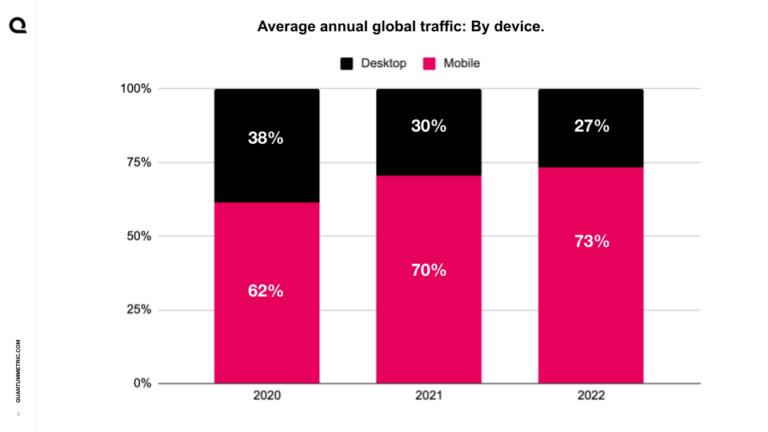

Surprisingly, conversion rates continue to climb as mobile adoption grows. Among travel brands using Quantum Metric, mobile (both native app and web) share grew 112% between 2020 and 2022, with 73% of traffic on mobile devices in 2022.

Mobile has broadened the traveler’s journey well beyond your typical booking. More travelers are now interacting with mobile travel apps for updates, check-in, in-flight options, upgrades, and other ancillary activities. Today, one in three consumers (31%) regularly use at least three travel apps. What we are seeing is how frequently they use them during their travel experience and how tied digital is to every touch point in the customer journey, even post-purchase.

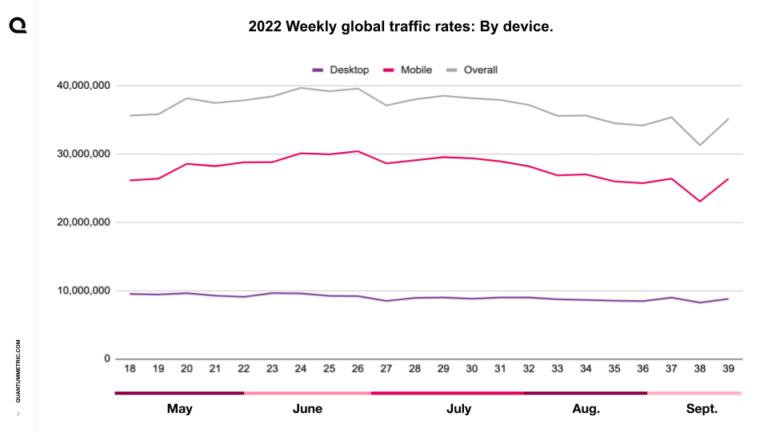

Breaking out traffic rates by device, we see that mobile traffic rates saw a 16% increase between May and July, growing at a rate of 2% per week. Meanwhile desktop saw a 5% decrease during the same period. As a result, average weekly traffic for April-June was 25% higher in 2022 than the prior year.

With mobile, travel brands have an opportunity to grow ancillary revenue.

So what does this mean for travel brands looking to build a more mobile-first experience? It’s time to cater to the needs and interests of your customers. Not just providing them with the best booking experiences, but creating more opportunities to make purchases, upgrade, and manage their trip from their phone, instead of needing to rely on hotel or airline staff.

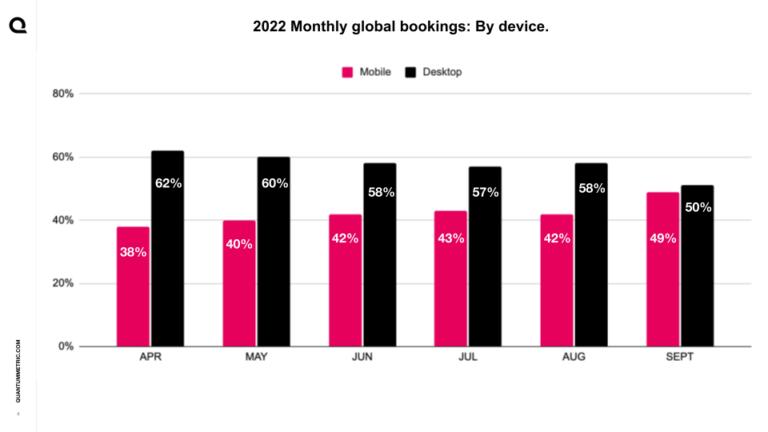

In fact, our data shows that this could be a big opportunity for travel brands to drive new revenue and differentiate from their competitors. Despite being the top driver of traffic, mobile only made up 40% of bookings during the summer months. Meaning all of the extra mobile traffic seen over the summer months wasn’t being driven into additional purchases or capitalized on as an opportunity to build a deeper relationship with travelers. In fact, we only see mobile compete with desktop once we hit September, when many are focused on bookings for the holiday season.

So what can travel brands do today to better meet customer expectations and respond to changing demand?

- Be transparent with your customers: Tighter wallets aren’t limiting consumers’ desire to travel, but it’s heightening their focus on value. With new guidelines and a renewed focus on cost, make sure you’re clear and transparent on pricing, offerings, and how customers can maximize their travel experience.

- Think beyond the booking: With the rise in mobile adoption, there are more ways to stay in touch with your customers, even after they have their reservation. How can you offer perks, add-ons, or upgrades that show you understand their needs?

- Go for mobile-fit, but omnichannel focused: Our benchmarks report found that the customer journey starts and ends on mobile, but consumers still interact with desktop and kiosk in between. Make sure your transitions between channels are seamless and provide your customers the opportunity to easily self-serve.

- Focus on digital efficiencies to build value: Invest in technologies that help automate previously manual processes to get a real-time understanding of customer behavior and new opportunities to drive revenue on mobile.

Want to know how you can get ahead of break-fixes, improve self-service across devices and examine loyalty flows to improve long-term customer retention? Check out our latest ebook, Remove traveler friction to boost loyalty, with the seven ways to get you started.

share

Share