FSI snapshot: Balancing banking customers’ needs.

It’s widely understood that the COVID-19 pandemic accelerated digital banking. As in-person services at branches closed, consumers were forced to manage some of their most sensitive transactions in an online environment. Banks were tasked with not just creating a seamless experience, but building trust and loyalty to their digital channels.

As restrictions ease and customers return to their branches in-person, how dependent are consumers on digital banking channels, today? And how have rising economic concerns increased their desire for seamless, instant connections to their accounts from wherever they are?

To answer these questions and others, we went back to the data—examining anonymized insights from some of the top global banking organizations to uncover how digital banking habits have evolved and what financial institutions should prepare for next.

Digital traffic is on the rise, as transactions hold steady.

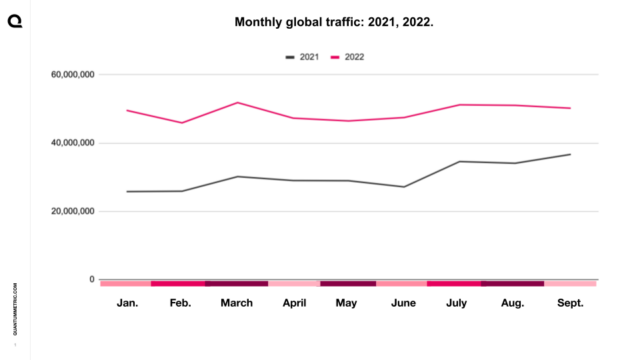

Even in a post-pandemic world, digital banking has not lost its hold. In fact, monthly digital traffic continues to grow seeing an average increase year-over-year of 64 percent between 2021 and 2022.

As personal financial concerns grow, so too do consumers’ dependence on digital to put them at ease. In fact, our survey results from earlier this year showed that 41% of consumers are checking their bank accounts almost every day to better manage their finances.

Meanwhile, another 26% admitted they avoid checking their balances, due to financial concerns. As we take a look at traffic, during the height of the summer, and inflation pricing, we see weekly traffic rates take a dip, which could be more consumers avoiding regular balance checks.

Where consumers are continuing to struggle is in completing digital transactions. While we saw continued growth in traffic, monthly and weekly transaction rates actually saw a 3% decline YoY, between 2021 and 2022. Between January and October, we also see only a 3% increase in monthly transactions.

For the 63% of consumers that continue to use both digital and live channel services, it comes down to trust and access. Digital issues or confusion interfaces can turn customers off and push them back into physical channels. It’s critical that banks are proactive in resolving issues to help put customers at ease.

Frustration is climbing, but self-service is minimizing digital leakage.

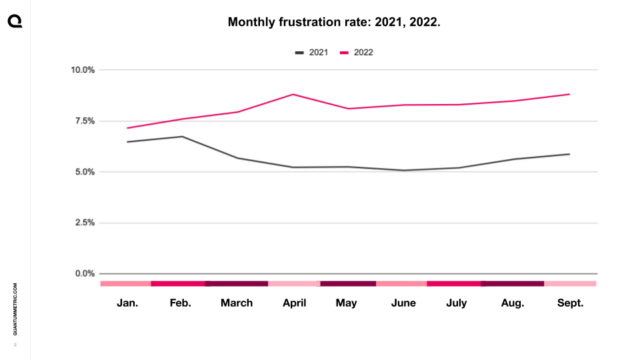

Not surprisingly, as traffic grows, we see more opportunities for digital frustration, especially as the likes of Amazon continue to set new benchmarks for digital excellence. Average weekly and monthly frustration rates grew 44% YoY between 2021 and 2022 and monthly frustration rates in 2022 alone saw a 14% increase.

However, how banks handle and resolve that frustration is key. Despite new digital tools, many customers still opt out of self-service at the first sign of trouble. In fact, 40% of our survey respondents say the first thing they do when they encounter an issue is call the contact center.

What’s interesting about our findings is that while frustration increased, abandoned transaction rates dropped YoY by 2%. This shows that Quantum Metric customers who invest in better self-service options are minimizing lost transactions. By monitoring the effectiveness of their self-service tools, brands can create more opportunities for customers to resolve issues themselves and improve their rate of completed transactions.

Desktop is still the traffic king, but mobile is getting more action.

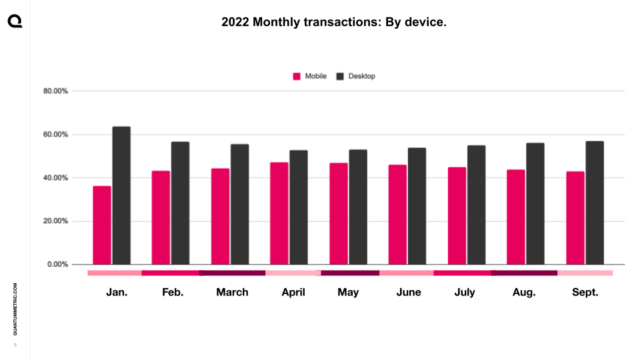

Mobile is quickly becoming a major competitor for desktop. When it comes to traffic, desktop still takes the lead, making up 57% of overall weekly traffic in 2022. However, more transactions are happening on mobile than ever before, with the channel seeing an average weekly transaction rate that is 12% higher than desktop. Taking a look year-over-year, we’ve seen mobile’s average weekly transaction rate grow by 10%.

Mobile’s biggest issue is the ability to self-serve when something doesn’t work out. Based on what other findings have shown, this could limit their future ability to grow their mobile transaction rate. While its weekly frustration rate is 23% lower than desktop, mobile has an abandoned transaction rate that is 12% higher than desktop. If a transaction doesn’t work on mobile, consumers opt-out for desktop or a live banking experience. Banks need to make it easy to navigate simple issues on mobile, without the need for live support.

A needed focus on ease and self-service.

Digital banking is primed to grow. What’s needed now is a focus on driving consumers to digital and then containing them in the channel. It’s about making it easy to complete digital transactions and self-serve when they are unsure of what to do next. As banks begin to build their strategies for 2023, here are a few ways they can prioritize self-service:

- Streamline customer journeys – What unnecessary steps stand in the way of your customers completing their transactions digitally? If you want to see better mobile engagement, focus on ways to simplify.

- Proactively remove customer friction – How can your team identify and respond to digital issues, faster? What’s preventing them from doing that, today? When it comes to digital issues it’s critical to solve issues before the customer brings them to you.

- Detect and rescue frustrated customers – When a customer gets stuck in a self-service experience, banks need to offer a real-time helping hand to customers, much in the same way a person in a branch would. This can help keep customers on digital, instead of always defaulting to live channels.

Want to learn more about how Quantum Metric can help you create more seamless customer experiences? Check out our latest ebook on how to remove friction and build digital maturity: https://www.quantummetric.com/resources/ebook/remove-friction-build-digital-maturity/